If you donate land and restrict its use to agricultural purposes you must value the land at its value for agricultural purposes. Household items include furniture furnishings electronics appliances linens and other similar items.

5 Items To Donate For A Charitable Tax Deduction Personal

5 Items To Donate For A Charitable Tax Deduction Personal

how to value furniture donations for tax purposes

how to value furniture donations for tax purposes is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in how to value furniture donations for tax purposes content depends on the source site. We hope you do not use it for commercial purposes.

It includes low and high estimates.

How to value furniture donations for tax purposes. The salvation army does not set a valuation on your donation. The condition of the piece tends to be far more important as is style. Depending on your income that could save you as much as 35 in taxes for every 100 worth of items you donate.

However when you itemize you give up the standard deduction. In many cases people donated used items that were worthless or nearly worthless and valued them for tax purposes as if they were new. Please choose a value within this range that reflects your items relative age and quality.

Donated furniture should not be evaluated at some fixed rate such as 15 of the cost of new. How to set the value of non monetary donations on income tax. Clothing and furniture donations in good condition.

As for things like linens they tend to retain very little value after theyve been used. When you donate furniture to a charity or some other tax exempt organization you can deduct the full value of your donation from your taxable income as long as you itemize your deductions. The donation value guide below helps you determine the approximate tax deductible value of some of the more commonly donated items.

Valuation abuses by taxpayers have been widespread for donations of clothing and household items. A property description the amount and terms of mortgages property surveys the assessed value the tax rate. Use the donation value guide to help determine the approximate tax deductible value of items commonly donated to the salvation army.

A type of sofa that was all the rage back in 2005 might have negligible value now and its certainly not an antique yet either. Sure you say ill do that. If you itemize deductions on your federal tax return you may be entitled to claim a charitable deduction for your goodwill donations.

Youll only save money on your taxes from donating furniture if you itemize your deductions. Use the donation value guide to help determine the approximate tax deductible value of items commonly donated to the salvation army. According to the internal revenue service irs a taxpayer can deduct the fair market value of clothing household goods used furniture shoes books and so forth.

The cost or actual selling price the sales price of comparable items the cost of replacement and the opinions of experts. Donated furniture must have value before you can use it for a deduction. In order to claim a deduction for tax purposes the irs recognizes four methods to determine the fair market value of household items like furniture and appliances.

Tax Guidelines For Donated Furniture Finance Zacks

Tax Guidelines For Donated Furniture Finance Zacks

Fair Market Value Ohio Valley Goodwill

Where To Donate Used Furniture To Charity

Where To Donate Used Furniture To Charity

Valuing Your Tax Deductible Donations Of Household Goods Don T

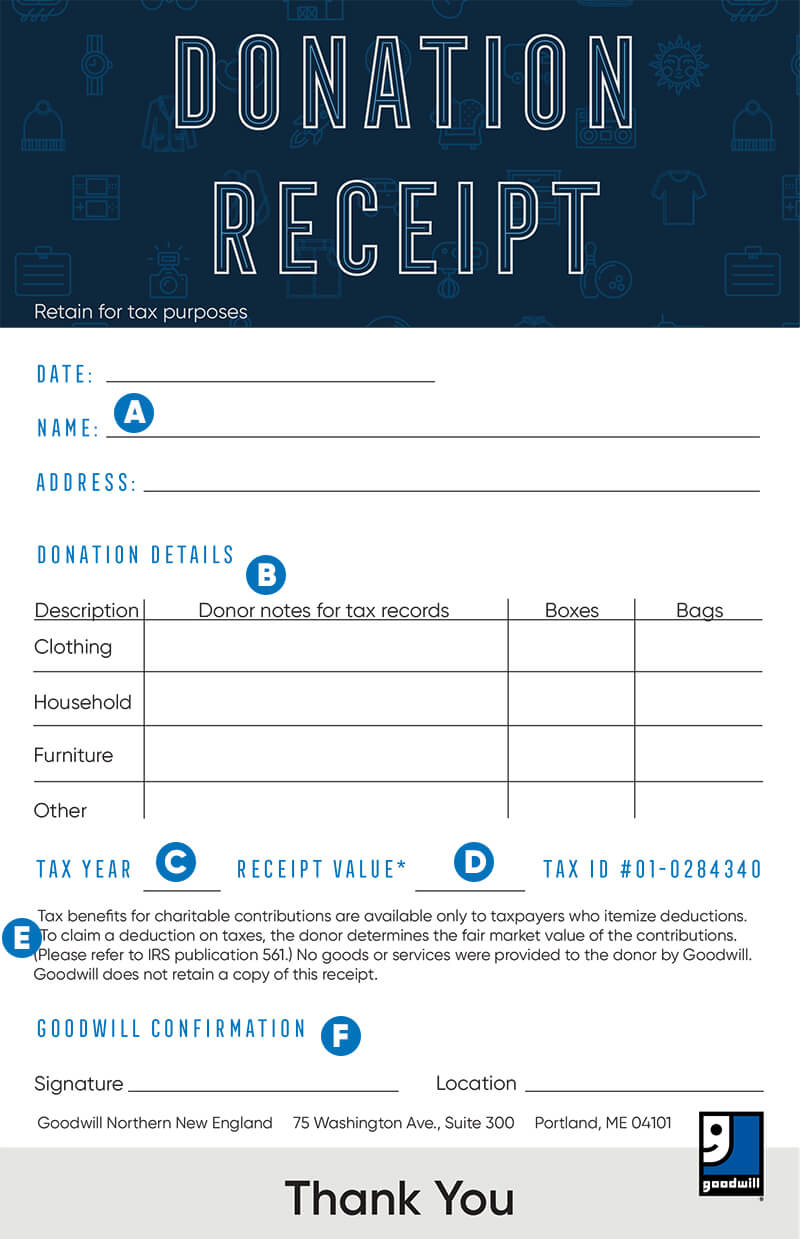

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

How To Fill Out A Goodwill Donation Tax Receipt Goodwill Nne

How To Get Tax Deductions On Goodwill Donations 15 Steps

How To Get Tax Deductions On Goodwill Donations 15 Steps

Charity Or Charitable Contributions Gifts As A Tax Return Deduction

Charity Or Charitable Contributions Gifts As A Tax Return Deduction

3 Ways To Figure Fair Market Value Donations Wikihow

3 Ways To Figure Fair Market Value Donations Wikihow

Donating Furniture In The Boston Area Organizations That Will

Donating Furniture In The Boston Area Organizations That Will

:max_bytes(150000):strip_icc()/GettyImages-583903612-5b588612c9e77c00785d6d7e.jpg)